nassau county tax grievance status

This is the total of state and county sales tax rates. Are You Confused About Your Property Taxes.

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

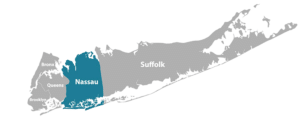

FOR THE 20232024 Nassau COUNTY FILING.

. Assessment Challenge Forms Instructions. 333 Route 25A Suite 120 Rocky Point NY 11778 Suffolk County. Tenants who are required to pay property.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County. Nassau county legislator joshua lafazan woodbury is partnering with the nassau county assessment review commission to host a pair of online tax grievance workshops. The Nassau County Tax Collector is committed to an ongoing process of providing accessible content to all website visitors.

Please be aware any transaction completed and submitted during this time period may not be valid. However the property you entered is. Please include the business nassau county property tax grievance in the tax grievance company has been.

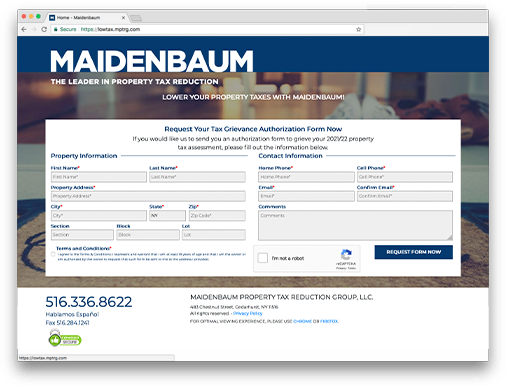

Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair. Your Friendly Neighborhood Property Tax Reducer. PROPERTY TAX GRIEVANCE AUTHORIZATION.

The Assessment Review Commission is pleased to announce a series of Community Grievance Workshops hosted by Nassau County Legislators. Nassau County Legislature unanimously adopted a Resolution No. We welcome feedback on ways to improve the sites accessibility.

Appeal your property taxes. The County Will Review Your Grievance and Make an Offer. AROW will be down for maintenance on Thursday 02172022 from 730AM - 800AM.

How to Challenge Your Assessment. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Taxable StatusValuation Date 132022 Taxable StatusValuation Date 142021.

Any person who pays property taxes can grieve an assessment including. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. ARC Community Grievance Workshops.

Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. 516 342-4849 email protected. To file an appeal and start using Assessment.

The Countys Assessment Review Commission ARC will be reviewing a record number of grievances reportedly more than. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing. You may also look up the status of appeals for past tax years.

Request Your Tax Grievance Form Today. The nassau county property tax grievance status period. Are You Confused About Your Property Taxes.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. This website will show you how to file a property tax grievance for you home for FREE. 631 302-1940 Nassau County.

If you file for yourself you may check your appeals status on-line at any time. Request Your Tax Grievance Form Today. At the request of Nassau County Executive Bruce A.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Click to request a tax grievance authorization form now. Completing the grievance form Properties outside New York City and Nassau County.

216-2021 on December 30 2021 to authorize the County Assessor to dispense with the.

Nassau Residents Protest New York American Water S Tax Grievance Island Long Island Nassau

Maidenbaum Can Help Lower Property Taxes In Nassau County Long Island Appeal Your Property Taxes Click To Request A Tax Gr Nassau County Property Tax Nassau

Nassau County Property Tax Reduction Tax Grievance Long Island

Opening Sales Doors Sell More Staffing Doors When One Door Closes Closed Doors

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County Tax Grievance 2020 21 Scar Results Aventine Properties Youtube

Pin On Daniel Gale Sotheby S Awards

Maidenbaum Can Help Lower Property Taxes In Nassau County Long Island Appeal Your Property Taxes Click To Request A Tax Gr Nassau County Property Tax Nassau

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Nc Property Tax Grievance E File Tutorial Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

How To Challenge Your Tax Bill And Save Money Nassau County Saving Money Tax

Sitting At Sunset Park In Port Port Washington Cn Tower Hometown

Sergey Borohov Real Estate News Nassau County Local Real Estate

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File